Status of pension funds in 2008

A report containing information from the annual financial statements of pension funds for the year 2008 is available at the Financial Supervisory Authority‘s (FME) webpage. There is also an excel file that contains statistical information from the report. The main results of the report are the following:

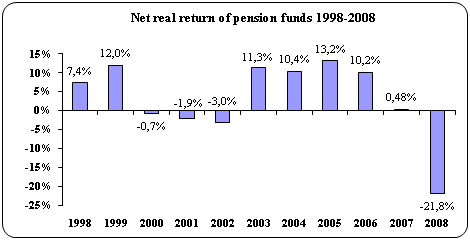

The real rate of return is -21.78% above the consumer-price index, compared to 0.5% in 2007. Five-year average is 2.5% and ten-year average is 3%. These negative impacts on pension fund‘s earnings can be attributed to difficulties in domestic and foreign financial markets and especially the fall of the Icelandic commercial banks in October 2008.

The report shows that net assets for pension payments amounted to ISK 1,600 billion at year-end 2008, compared to ISK 1,700 billion at the same time in the year 2007. This corresponds to an annual loss of 6% or a negative real return of 19% as measured above the consumer price index.

Premiums decreased between years from ISK 146 billion in the year 2007 to ISK 116 billion in the year 2008. This corresponds to an annual decrease of 26%. The main reason for this reduction is that in the year 2008 two pension funds sold their holdings in Landsvirkjun, i.e. Lífeyrissjóður starfsmanna Reykjavíkurborgar which sold its share to 23.9 billion and Lífeyrissjóður starfsmanna Akureyrarbæjar which sold its share of 3 billion. The payment for the sale was received as deposit premiums from Akureyri and Reykjavík. Pensions paid in the year 2008 amounted to ISK 53 billion, compared to ISK 46 billion in the year 2007.

Private pension savings deposited with pension funds and other depositories amounted to ISK 256 billion at year-end 2008, compared to ISK 238 billion at the same time in the year 2007. This corresponds to an annual increase of 7.5%. Private pension savings in total amounted to approximately 16% of the total assets of the entire pension system at year-end 2008. Private pension savings premiums increased by 2.4% and totalled ISK 33.4 billion in the year 2008, compared to ISK 32.6 billion in the year 2007.

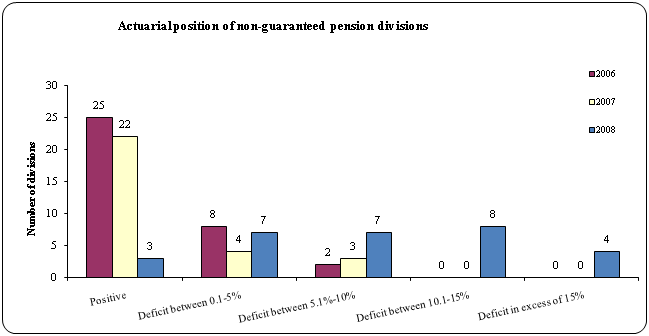

According to Act 129/1997 on the Mandatory Guarantee of Pension Rights and the Operations of Pension Funds, the assets of a pension fund together with the present value of future premiums shall equal the present value of estimated pension payments. All pension funds showing a deficit of 10% or higher as calculated by annual actuarial survey must amend their Articles of Association in order to achieve a balance. Any fund showing a negative position ranging from 5%-10% for a period of 5 consecutive years must also change its Articles of Association to regain equilibrium. On 29 December 2008, a transitional provision was added which authorized pension funds to have up to 15% difference between the assets and present value of estimated pension payments based on actual valuation for the year 2008, without making changes to the Articles of Association of the fund. At year-end 2008 the position of 26 non-guaranteed mutual funds out of a total of 29 was negative, of which 4 with a deficit in excess of 15%. The only exemption from this provision is in the case of funds that are guaranteed by the state, municipal authorities or a bank. The balance of guaranteed pension funds is similar between years and almost all of the divisions show a significant deficit.

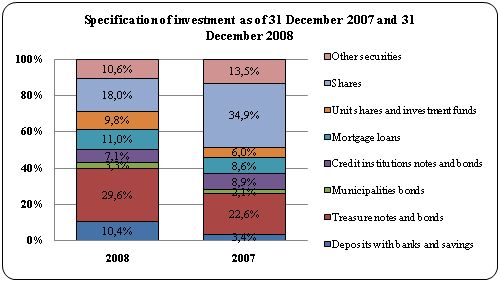

About 8.6% of pension fund‘s investments are in non-listed securities at year-end 2008, compared to 6.1% at the same time in the year 2007. According to Act 129/1997 pension funds are authorized to invest maximum 10% of their assets in non-listed securities. Non-listed securities as defined by Article 36 are securities that do not have a registered buying and selling rate on a regulated market. On 29 December 2008 the permission to invest in unlisted securities was increased to 20%. Foreign currency exposures totalled 29% at year-end 2008, compared to 27% at year-end 2007.

The picture below shows the specification of the pension fund‘s portfolio assets as of 31 December 2008 and 31 December 2007, where it is noticeable that share holdings have decreased between these periods and deposits increased. The main reason for this is considered to be the collapse of the banking system and difficulties in domestic and foreign markets. Pension funds have written off part of their share holdings as well as credit institutions and corporate notes and bonds and moved part of their investments in deposits.

The report will only be available on FME‘s website.

Annual Accounts and Diverse Figures 2008

Tables from Annual Accounts 2008

For further information contact Sigurður G. Valgeirsson, sgv@fme.is, telephone: 525-2700 and mobile phone: 840-3861