FME: Total profit of insurance companies was 13.5 bn. ISK in 2007

The total after tax profit of domestic insurance companies was 13.5 bn. ISK in 2007 compared to 19.5 bn. ISK in 2006.

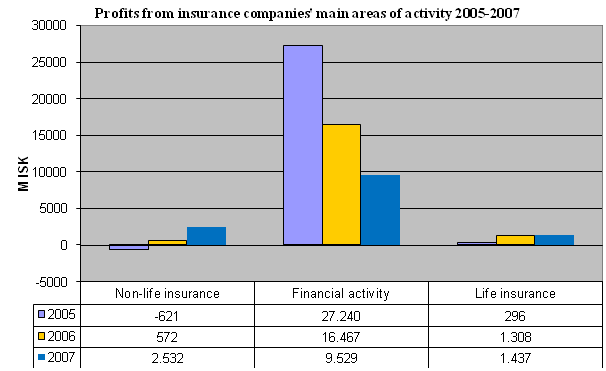

Around 70% of the profit stems from financial activities. However, the profit from financial activities decreased with 8 bn. ISK compared to 2006 and 17 bn. ISK compared to 2005.

The return of non-life activities has been improving since 2005, mainly due to increase in premiums.

The balance sheet of non-life companies increased slightly, to 160 bn. ISK, for 156 bn. ISK in 2006.

The following figure shows the pre-tax profit from insurance companies' main areas of activity 2005-2007, adjusted to 2007 price levels.

The Financial Supervisory Authority (FME) has published on the website tables with annual accounts of insurance companies and the activity in insurance classes for the year 2007. The tables are based on data from the companies.

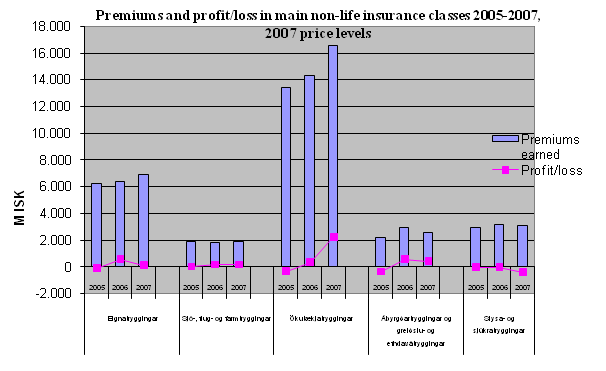

The main classes of non-life insurance, except accident and sickness insurance, made profit in 2007, which was also the case in 2006.

The biggest increase in premiums was in motor insurance, or 22%, which is corresponding to 15.7% real increase above inflation. Around 59% of non-life insurance premiums come from motor insurance. The profit in motor insurance increased significantly, it was 2.2. bn ISK in 2007 compared to 314 m ISK last and a loss in 2005.

The real increase in premiums in compulsory motor insurance was 13%, but corresponding increase in other motor insurance was 22%. However, the class other motor was still producing a loss amounting to 500 m ISK in 2007.

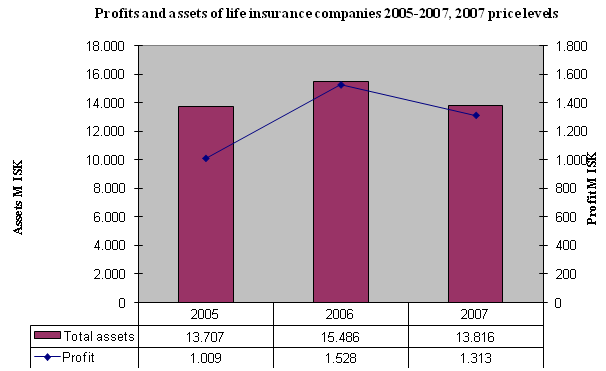

The life insurance companies profit decreased slightly last year, to 1.3 bn ISK compared to 1.5 bn. ISK in 2006. All the life insurance companies are owned by non-life companies or other companies in the financial market. Due to restructuring of one company, the balance sheet decreased last year.

Excel tables with annual accounts and insurance classes.

For further information please contact: Íris Björk Hreinsdóttir, iris@fme.is, Tel: (+354) 525 2700.